The Most & Least Car-Dependent Cities [+ Miles per Driver]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jul 1, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jul 1, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The 10 least car-dependent metros averaged 9,339 miles per driver during our study period

- The 10 most car-dependent metros averaged 13,781 miles per driver during our study period

- Seattle is the least car-dependent metro with drivers averaging 8,400 miles annually

- Memphis is the most car-dependent metro with drivers averaging 14,959 miles annually

Getting a driver’s license used to be a right of passage for 16-year-olds. But increasingly, more teens are putting off getting their licenses. According to data from the Federal Highway Administration, fewer than 26 percent of 16-year-olds were licensed drivers in 2018, down from 44 percent in 1980.

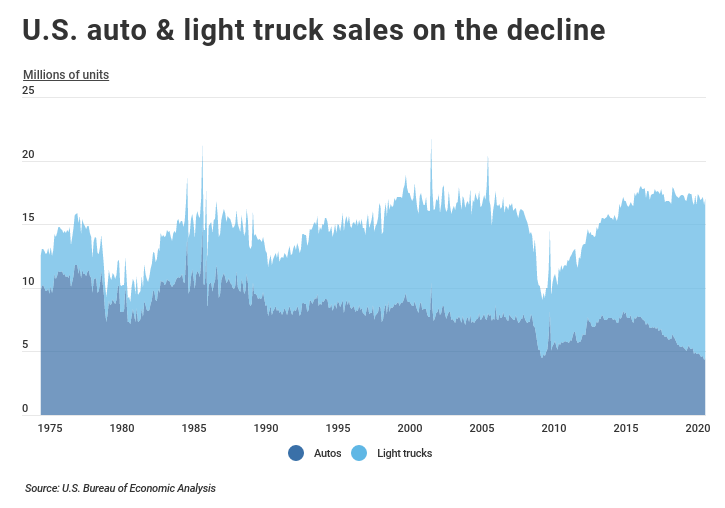

This phenomenon is part of a general shift in America’s car culture. Auto sales have been declining for the last few years, and there has been an increase in other forms of transportation, such as ride-sharing, bike share, and scooters. In this article, we take a look at car dependency by city in the US and see which metros rely on cars the most and least.

This it determined by things like average driver age, availability of public transport, average mileage for each car and driver, and other factors. While many of the cities with the most robust public transportation systems also have a lot of traffic, it can still reduce the average cost for each licensed driver in that city compared to if the average person relied on a car to get around.

While the country as a whole continues to rely heavily on cars, a new trend towards less car dependency is emerging among certain demographics. In addition to fewer teen drivers, more Americans are working from home. Between 2010 and 2018, the share of home-based workers increased from 4.3 to 5.3 percent, while the share of car commuters decreased from 86.3 to 85.3 percent. For a licensed driver in the US, this could lead to less time on the road, fewer accidents, and a better overall risk profile.

Despite the decline in auto sales and increased popularity of alternative modes of transportation, America remains a global leader when it comes to driving.

Compared to Western European countries, the U.S. is more car-dependent for a variety of reasons, including its size, suburban sprawl, less expensive gas, and underdeveloped public transportation. In many U.S. cities, driving a car is practically a necessity to get to work, school, or the grocery store.

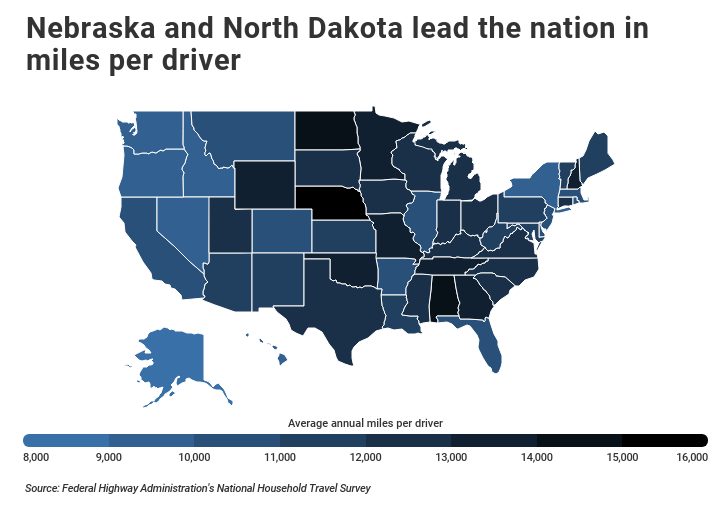

Car dependency varies widely across cities and states, depending on public transportation options, geography, bikeability, walkability, and culture. Nebraska and North Dakota claim the top two spots in the country for average annual miles per driver, with drivers in these states driving an average of 15,390 and 14,393 annual miles, respectively. The national average is 11,621 miles. Alaskan residents drive the fewest, at just over 8,000 miles annually.

To determine our rankings of car dependency by city in the U.S., our researchers here at CompareCarInsurance.com analyzed data from the Federal Highway Administration’s National Household Transportation Survey and the U.S Census Bureau’s American Community Survey.

Major metropolitan areas with over one million residents were ranked according to the average annual miles per driver. The researchers also calculated the average annual miles per vehicle, the share of workers who commute by car, and the share of workers in households with two or more vehicles available.

The most car-dependent locations tend to be sprawling metropolitan areas with less developed public transportation systems. In addition to having higher average annual miles per driver, the most car-dependent metros tend to have higher annual miles per vehicle, more workers who commute by car, and larger shares of workers in households with 2 or more vehicles.

Many of the least car-dependent metros, such as New York, San Francisco, and Boston, have well-developed public transportation systems and a large number of people living in their urban cores. Other less car-dependent metros, including Seattle and Portland, are more bike-friendly and walkable.

These metros tend to have fewer car commuters and fewer households with 2 or more vehicles available. In this article, we will cover the 10 most car-dependent metros in the United States and the 10 least car-dependent metros in the United States.

If you’re on this page, you’re likely looking for car insurance as well. Car insurance, however, can be tricky to understand due to its industry terminology and the opaque nature of the factors that influence it. If you’re new to car insurance or just want a brush up on different coverages, check out our compare car insurance coverage page.

How does population density in One of the factors that influence your car insurance rates is your annual mileage. More miles generally equals higher insurance rates, and if there’s one thing people surely want, it’s spending less money on car insurance. In short, every time you get on the road, you’re at risk of being in a wreck or getting a ticket. The more time you spend on the road (and the higher your annual mileage), the higher this risk becomes. If you are dependent on your car and want to get the best insurance rates for your area, just enter your ZIP code into our FREE online quote comparison tool.

In this article, we’ll dive deep into car dependency in America and car-dependent cities. We’ll also cover a car dependency definition, how cities are adapted to cars, the negative effects of automobile dependency, and how cars ruin cities (in some ways). Now, let’s get started with the 10 most car-dependent metros.

The 10 Most Car-Dependent Metros

#10 – Virginia Beach–Norfolk–Newport News, VA–NC

- Average annual miles per driver: 12,996

- Average annual miles per vehicle: 11,694

- Share of workers who commute by car: 89.7%

- Share of workers in households with 2+ vehicles: 77.1%

TRENDING

The vehicle you drive is one of the most important factors in determining your car insurance premium. Use our website to find car insurance rates for popular vehicles like car insurance rates for a Dodge Charger or car insurance rates for a Honda CRV.

#9 – Jacksonville, FL

- Average annual miles per driver: 13,073

- Average annual miles per vehicle: 11,928

- Share of workers who commute by car: 88.7%

- Share of workers in households with 2+ vehicles: 75.7%

#8 – Cincinnati, OH–KY–IN

- Average annual miles per driver: 13,260

- Average annual miles per vehicle: 11,697

- Share of workers who commute by car: 89.8%

- Share of workers in households with 2+ vehicles: 78.6%

#7 – Detroit–Warren–Dearborn, MI

- Average annual miles per driver: 13,347

- Average annual miles per vehicle: 12,841

- Share of workers who commute by car: 91.8%

- Share of workers in households with 2+ vehicles: 76.1%

#6 – Charlotte–Concord-Gastonia, NC-SC

- Average annual miles per driver: 13,398

- Average annual miles per vehicle: 11,578

- Share of workers who commute by car: 88.6%

- Share of workers in households with 2+ vehicles: 78.5%

#5 – Richmond, VA

- Average annual miles per driver: 13,632

- Average annual miles per vehicle: 12,284

- Share of workers who commute by car: 89.8%

- Share of workers in households with 2+ vehicles: 79.5%

#4 – St. Louis, MO–IL

- Average annual miles per driver: 14,114

- Average annual miles per vehicle: 12,216

- Share of workers who commute by car: 90.5%

- Share of workers in households with 2+ vehicles: 77.2%

#3 – Oklahoma City, OK

- Average annual miles per driver: 14,287

- Average annual miles per vehicle: 13,203

- Share of workers who commute by car: 91.7%

- Share of workers in households with 2+ vehicles: 78.3%

#2 – Nashville–Davidson–Murfreesboro–Franklin, TN

- Average annual miles per driver: 14,745

- Average annual miles per vehicle: 11,262

- Share of workers who commute by car: 90.2%

- Share of workers in households with 2+ vehicles: 80.6%

#1 – Memphis, TN–MS–AR

- Average annual miles per driver: 14,959

- Average annual miles per vehicle: 11,389

- Share of workers who commute by car: 95.0%

- Share of workers in households with 2+ vehicles: 73.9%

RELATED

Regardless of your situation, we can help you find the right car insurance policy for you. Our research team has put together everything you need to know about specialty insurance policies like car insurance for first-time drivers over 30 or 1-week car insurance.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

The 10 Least Car-Dependent Metros

#10 – Chicago–Naperville–Elgin, IL–IN–WI

- Average annual miles per driver: 9,946

- Average annual miles per vehicle: 10,658

- Share of workers who commute by car: 77.8%

- Share of workers in households with 2+ vehicles: 70.4%

#9 – Boston–Cambridge–Newton, MA–NH

- Average annual miles per driver: 9,717

- Average annual miles per vehicle: 11,623

- Share of workers who commute by car: 73.1%

- Share of workers in households with 2+ vehicles: 69.2%

#8 – Philadelphia–Camden–Wilmington, PA–NJ–DE–MD

- Average annual miles per driver: 9,611

- Average annual miles per vehicle: 12,007

- Share of workers who commute by car: 79.6%

- Share of workers in households with 2+ vehicles: 70.6%

#7 – Pittsburgh, PA

- Average annual miles per driver: 9,571

- Average annual miles per vehicle: 9,535

- Share of workers who commute by car: 84.9%

- Share of workers in households with 2+ vehicles: 73.3%

#6 – Las Vegas–Henderson–Paradise, NV

- Average annual miles per driver: 9,545

- Average annual miles per vehicle: 11,402

- Share of workers who commute by car: 88.5%

- Share of workers in households with 2+ vehicles: 73.1%

DID YOU KNOW?

When buying a new car, you are required by law to have insurance at the time you become the vehicle owner. Depending on the situation, young drivers may get a car under their parents’ insurance.

#5 – Portland–Vancouver–Hillsboro, OR–WA

- Average annual miles per driver: 9,491

- Average annual miles per vehicle: 10,221

- Share of workers who commute by car: 79.2%

- Share of workers in households with 2+ vehicles: 75.7%

#4 – San Francisco–Oakland–Hayward, CA

- Average annual miles per driver: 9,376

- Average annual miles per vehicle: 10,526

- Share of workers who commute by car: 66.8%

- Share of workers in households with 2+ vehicles: 69.5%

#3 – San Jose–Sunnyvale–Santa Clara, CA

- Average annual miles per driver: 8,931

- Average annual miles per vehicle: 10,134

- Share of workers who commute by car: 85.6%

- Share of workers in households with 2+ vehicles: 81.5%

#2 – New York–Newark–Jersey City, NY–NJ–PA

- Average annual miles per driver: 8,801

- Average annual miles per vehicle: 10,699

- Share of workers who commute by car: 56.5%

- Share of workers in households with 2+ vehicles: 51.7%

#1 – Seattle–Tacoma–Bellevue, WA

- Average annual miles per driver: 8,400

- Average annual miles per vehicle: 9,191

- Share of workers who commute by car: 76.1%

- Share of workers in households with 2+ vehicles: 74.3%

Complete Results of Car Dependency by City

| Metro Area | Avg. Annual Miles (Per Driver) | Avg. Annual Miles (Per Vehicle) | Percentage of Commuters | Households with 2+ Vehicles | Population (2018) | Rank |

|---|---|---|---|---|---|---|

| Memphis, TN-MS-AR | 14,959 | 11,389 | 95.0% | 73.9% | 1,350,620 | 1 |

| Nashville-Davidson--Murfreesboro--Franklin, TN | 14,745 | 11,262 | 90.2% | 80.6% | 1,930,961 | 2 |

| Oklahoma City, OK | 14,287 | 13,203 | 91.7% | 78.3% | 1,396,445 | 3 |

| St. Louis, MO-IL | 14,114 | 12,216 | 90.5% | 77.2% | 2,805,465 | 4 |

| Richmond, VA | 13,632 | 12,284 | 89.8% | 79.5% | 1,306,172 | 5 |

| Charlotte-Concord-Gastonia, NC-SC | 13,398 | 11,578 | 88.6% | 78.5% | 2,569,213 | 6 |

| Detroit-Warren-Dearborn, MI | 13,347 | 12,841 | 91.8% | 76.1% | 4,326,442 | 7 |

| Cincinnati, OH-KY-IN | 13,260 | 11,697 | 89.8% | 78.6% | 2,190,209 | 8 |

| Jacksonville, FL | 13,073 | 11,928 | 88.7% | 75.7% | 1,534,701 | 9 |

| Virginia Beach-Norfolk-Newport News, VA-NC | 12,996 | 11,694 | 89.7% | 77.1% | 1,728,733 | 10 |

| Atlanta-Sandy Springs-Roswell, GA | 12,940 | 12,019 | 86.1% | 76.8% | 5,949,951 | 11 |

| Houston-The Woodlands-Sugar Land, TX | 12,809 | 12,335 | 90.4% | 77.6% | 6,997,384 | 12 |

| Grand Rapids-Wyoming, MI | 12,798 | 12,167 | 91.1% | 81.3% | 1,069,405 | 13 |

| Dallas-Fort Worth-Arlington, TX | 12,714 | 12,303 | 90.4% | 79.1% | 7,539,711 | 14 |

| Louisville/Jefferson County, KY-IN | 12,480 | 11,970 | 90.7% | 77.1% | 1,297,301 | 15 |

| Birmingham-Hoover, AL | 12,373 | 11,799 | 93.6% | 80.7% | 1,151,801 | 16 |

| Austin-Round Rock, TX | 12,341 | 11,815 | 85.7% | 77.8% | 2,168,316 | 17 |

| Riverside-San Bernardino-Ontario, CA | 12,274 | 10,971 | 90.7% | 86.0% | 4,622,361 | 18 |

| Cleveland-Elyria, OH | 12,272 | 12,034 | 89.4% | 73.4% | 2,057,009 | 19 |

| Minneapolis-St. Paul-Bloomington, MN-WI | 12,047 | 12,719 | 85.5% | 79.8% | 3,629,190 | 20 |

| Baltimore-Columbia-Towson, MD | 11,961 | 11,112 | 84.9% | 75.0% | 2,802,789 | 21 |

| New Orleans-Metairie, LA | 11,959 | 11,730 | 87.8% | 69.2% | 1,270,399 | 22 |

| Rochester, NY | 11,941 | 11,743 | 88.8% | 75.6% | 1,071,082 | 23 |

| Phoenix-Mesa-Scottsdale, AZ | 11,914 | 10,501 | 87.0% | 77.2% | 4,857,962 | 24 |

| Milwaukee-Waukesha-West Allis, WI | 11,829 | 11,291 | 89.0% | 74.3% | 1,576,113 | 25 |

| San Antonio-New Braunfels, TX | 11,821 | 11,117 | 90.4% | 78.0% | 2,518,036 | 26 |

| Providence-Warwick, RI-MA | 11,696 | 11,184 | 89.8% | 77.3% | 1,621,337 | 27 |

| Hartford-West Hartford-East Hartford, CT | 11,653 | 10,091 | 88.9% | 76.8% | 1,206,300 | 28 |

| Salt Lake City, UT | 11,640 | 9,691 | 86.5% | 81.9% | 1,222,540 | 29 |

| Raleigh, NC | 11,631 | 11,576 | 87.9% | 80.0% | 1,362,540 | 30 |

| Indianapolis-Carmel-Anderson, IN | 11,554 | 9,778 | 91.4% | 77.8% | 2,048,703 | 31 |

| Columbus, OH | 11,432 | 11,233 | 89.5% | 77.5% | 2,106,541 | 32 |

| Kansas City, MO-KS | 11,298 | 11,735 | 91.6% | 79.1% | 2,143,651 | 33 |

| Denver-Aurora-Lakewood, CO | 11,270 | 10,742 | 83.2% | 78.6% | 2,932,415 | 34 |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 11,092 | 10,459 | 75.0% | 71.9% | 6,249,950 | 35 |

| Tampa-St. Petersburg-Clearwater, FL | 10,986 | 12,479 | 87.9% | 74.0% | 3,142,663 | 36 |

| Los Angeles-Long Beach-Anaheim, CA | 10,955 | 10,724 | 84.5% | 77.2% | 13,291,486 | 37 |

| Orlando-Kissimmee-Sanford, FL | 10,839 | 12,046 | 90.7% | 75.6% | 2,572,962 | 38 |

| San Diego-Carlsbad, CA | 10,666 | 11,098 | 85.2% | 80.3% | 3,343,364 | 39 |

| Buffalo-Cheektowaga-Niagara Falls, NY | 10,325 | 11,535 | 88.9% | 70.6% | 1,130,152 | 40 |

| Sacramento--Roseville--Arden-Arcade, CA | 10,127 | 10,994 | 85.7% | 80.5% | 2,345,210 | 41 |

| Miami-Fort Lauderdale-West Palm Beach, FL | 10,101 | 10,824 | 86.9% | 72.9% | 6,198,782 | 42 |

| Chicago-Naperville-Elgin, IL-IN-WI | 9,946 | 10,658 | 77.8% | 70.4% | 9,498,716 | 43 |

| Boston-Cambridge-Newton, MA-NH | 9,717 | 11,623 | 73.1% | 69.2% | 4,875,390 | 44 |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 9,611 | 12,007 | 79.6% | 70.6% | 6,096,372 | 45 |

| Pittsburgh, PA | 9,571 | 9,535 | 84.9% | 73.3% | 2,324,743 | 46 |

| Las Vegas-Henderson-Paradise, NV | 9,545 | 11,402 | 88.5% | 73.1% | 2,231,647 | 47 |

| Portland-Vancouver-Hillsboro, OR-WA | 9,491 | 10,221 | 79.2% | 75.7% | 2,478,810 | 48 |

| San Francisco-Oakland-Hayward, CA | 9,376 | 10,526 | 66.8% | 69.5% | 4,729,484 | 49 |

| San Jose-Sunnyvale-Santa Clara, CA | 8,931 | 10,134 | 85.6% | 81.5% | 1,999,107 | 50 |

| New York-Newark-Jersey City, NY-NJ-PA | 8,801 | 10,699 | 56.5% | 51.7% | 19,979,477 | 51 |

| Seattle-Tacoma-Bellevue, WA | 8,400 | 9,191 | 76.1% | 74.3% | 3,939,363 | 52 |

Complete Results of Car Dependency by State

| State | Avg. Annual Miles (Per Driver) | Avg. Annual Miles (Per Vehicle) | Percentage of Commuters | Households with 2+ Vehicles | Population (2018) | Rank |

|---|---|---|---|---|---|---|

| Nebraska | 15,390 | 12,357 | 90.8% | 81.2% | 1,929,268 | 1 |

| North Dakota | 14,393 | 10,494 | 90.9% | 79.6% | 760,077 | 2 |

| Alabama | 14,062 | 11,115 | 94.2% | 80.0% | 4,887,871 | 3 |

| Missouri | 13,818 | 10,956 | 90.7% | 77.7% | 6,126,452 | 4 |

| Tennessee | 13,770 | 11,564 | 92.0% | 79.8% | 6,770,010 | 5 |

| New Hampshire | 13,515 | 11,477 | 88.2% | 82.6% | 1,356,458 | 6 |

| Oklahoma | 13,188 | 12,565 | 92.0% | 78.4% | 3,943,079 | 7 |

| Wyoming | 13,173 | 10,527 | 85.9% | 82.8% | 577,737 | 8 |

| Minnesota | 13,147 | 12,021 | 86.1% | 80.4% | 5,611,179 | 9 |

| Georgia | 13,030 | 11,940 | 88.8% | 76.8% | 10,519,475 | 10 |

| South Dakota | 12,955 | 10,426 | 89.8% | 81.1% | 882,235 | 11 |

| Ohio | 12,702 | 11,074 | 90.6% | 77.5% | 11,689,442 | 12 |

| Texas | 12,695 | 12,016 | 90.5% | 78.1% | 28,701,845 | 13 |

| Kentucky | 12,684 | 12,277 | 91.8% | 78.5% | 4,468,402 | 14 |

| Wisconsin | 12,609 | 11,518 | 89.2% | 79.2% | 5,813,568 | 15 |

| Virginia | 12,589 | 11,054 | 85.8% | 79.0% | 8,517,685 | 16 |

| Michigan | 12,588 | 11,803 | 90.9% | 77.5% | 9,995,915 | 17 |

| North Carolina | 12,540 | 11,390 | 90.0% | 78.3% | 10,383,620 | 18 |

| Mississippi | 12,501 | 11,607 | 94.4% | 77.9% | 2,986,530 | 19 |

| South Carolina | 12,416 | 11,334 | 90.9% | 77.4% | 5,084,127 | 20 |

| Iowa | 12,415 | 10,571 | 89.7% | 81.2% | 3,156,145 | 21 |

| Utah | 12,341 | 9,625 | 86.9% | 84.9% | 3,161,105 | 22 |

| Indiana | 12,338 | 10,602 | 91.8% | 78.2% | 6,691,878 | 23 |

| Connecticut | 12,014 | 10,395 | 86.1% | 76.2% | 3,572,665 | 24 |

| West Virginia | 11,993 | 11,890 | 91.8% | 75.5% | 1,805,832 | 25 |

| Louisiana | 11,955 | 11,510 | 91.8% | 72.6% | 4,659,978 | 26 |

| Kansas | 11,943 | 10,343 | 91.3% | 80.7% | 2,911,510 | 27 |

| Arizona | 11,785 | 10,429 | 87.1% | 76.8% | 7,171,646 | 28 |

| Maine | 11,662 | 11,396 | 87.7% | 78.8% | 1,338,404 | 29 |

| Vermont | 11,607 | 10,886 | 84.4% | 78.0% | 626,299 | 30 |

| Maryland | 11,588 | 11,379 | 83.2% | 75.4% | 6,042,718 | 31 |

| Pennsylvania | 11,391 | 10,758 | 84.0% | 73.0% | 12,807,060 | 32 |

| New Mexico | 11,365 | 10,554 | 90.5% | 77.7% | 2,095,428 | 33 |

| Arkansas | 10,915 | 10,135 | 93.1% | 78.2% | 3,013,825 | 34 |

| Florida | 10,906 | 11,622 | 88.4% | 74.7% | 21,299,325 | 35 |

| Colorado | 10,798 | 10,148 | 83.5% | 80.0% | 5,695,564 | 36 |

| California | 10,671 | 10,793 | 83.8% | 78.9% | 39,557,045 | 37 |

| Montana | 10,607 | 8,828 | 84.4% | 82.0% | 1,062,305 | 38 |

| New Jersey | 10,509 | 11,269 | 79.0% | 71.4% | 8,908,520 | 39 |

| Delaware | 10,502 | 12,337 | 88.7% | 79.0% | 967,171 | 40 |

| Illinois | 10,439 | 10,690 | 80.9% | 72.1% | 12,741,080 | 41 |

| Massachusetts | 10,295 | 10,943 | 77.2% | 70.9% | 6,902,149 | 42 |

| Rhode Island | 10,024 | 11,544 | 89.4% | 77.4% | 1,057,315 | 43 |

| Idaho | 9,825 | 10,024 | 88.7% | 82.1% | 1,754,208 | 44 |

| Oregon | 9,507 | 9,632 | 81.2% | 76.7% | 4,190,713 | 45 |

| Washington | 9,454 | 9,649 | 80.7% | 78.0% | 7,535,591 | 46 |

| District of Columbia | 9,219 | 10,623 | 39.3% | 31.2% | 702,455 | 47 |

| Hawaii | 9,169 | 11,359 | 82.0% | 76.5% | 1,420,491 | 48 |

| New York | 9,082 | 11,087 | 59.4% | 52.1% | 19,542,209 | 49 |

| Nevada | 9,006 | 10,816 | 88.7% | 74.7% | 3,034,392 | 50 |

| Alaska | 8,011 | 8,689 | 80.3% | 73.5% | 737,438 | 51 |

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Frequently Asked Questions: Benefits & Consequences of Automobiles

Now that we’ve covered the 10 most and 10 least car-dependent cities, let’s get to your frequently asked questions. They include:

- How can I reduce my car dependency?

- How did the car affect cities?

- What are the negative effects of automobiles?

Scroll down for the answers to those questions and more.

#1 – How can I reduce my car dependency?

A quick way to reduce car dependency is simple: Don’t use your car. There are other means of transportation like public buses, group commutes through rideshare companies or even the basic exercising through walking or riding a bicycle. The environment benefits and you win as well by saving on fuel costs and your auto insurance with good driver and low-mileage discounts.

#2 – Which city is known for the automobile industry?

Detroit is known as Motor City due to its role in the productions of automobiles during the early 1900s. Major automobile manufacturers formed in that city during that time, pumping out cars to an American public enamored with the idea of free, quick travel from location to location. Even now, many auto factories are located in or around Detroit.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

#3 – How did the car affect cities?

The car affected cities by creating urban sprawl, a process that saw the growth of suburbs just outside of cities with their own jurisdictions and rule of law. With people able to commute quickly to work, there was no longer a reason to stay within walking or exercising distance from an office. Many people moved to suburbs while still keeping city-based jobs. Those who live in suburbs now may pay increased insurance rates due to higher vehicle miles and hours in traffic each day.

#4 – What are the positive effects of automobiles?

The positive effects of automobiles include the ability to move from place to place rapidly, which can increase efficiency and eliminate dead time that can be used for other things. It also has led to a growth in the personal transport industry, the transportation industry in general, and the infrastructure and development of trucking. For many people, it opens doors to allow people to migrate and take advantage of more opportunities professionally and otherwise.

#5 – What are the negative effects of automobiles?

One of the negative impacts of automobile dependency is pollution. The original automobiles, and most of those that are still used today, employed the internal combustion engine as the way to propel forward. This mechanism burned fossil fuels and resulted in global warming as the increased carbon pollution became trapped in the atmosphere, slowly warming the earth, leading to some negative effects we see today like the melting of glaciers and rising sea levels.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

#6 – How do cars harm the environment?

They do so by burning gasoline and oil, which are released into the atmosphere as a form of pollution. This causes the atmosphere to trap sunlight beneath it, slowly warming the earth to the point where we see issues today like the melting of glaciers and rising sea levels.

#7 – Why is the car so important?

The car is important because it can have a major positive impact on the economy by allowing us to move from place to place quicker. This is true not just of city dwellers but also people who live in a rural environment where stores and locations might be more spaced out.

#8 – How did cars help the economy?

The invention of the car caused dozens of industries to spin-off including the rubber industry, the highway and infrastructure industry, and the transportation industry (with trucks and personal transport).

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Methodology: Determining the Most & Least Car-Dependent Cities

To find the most and least car-dependent metropolitan areas, researchers here at CompareCarInsurance.com analyzed data from the Federal Highway Administration’s 2017 National Household Travel Survey and from the U.S. Census Bureau’s 2018 American Community Survey.

Car dependency was measured by the average annual miles per driver. Researchers also calculated the average annual miles per vehicle, the share of workers who commute by car, and the share of workers in households with two or more vehicles available. Only large metropolitan areas with over one million residents were included in the analysis.

As we’ve seen, a person who drives more miles generally pays more for car insurance. But there are still ways to save on rates from discounts to quote comparisons, even if you are heavily dependent on your car. To save more on your car insurance rate, just plug your ZIP code into our online quote generator. It’ll give you the best rates based on your demographic information, driving history, and location.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.