How do insurance companies value cars?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Dec 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Dec 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The amount your insurance company pays you depends on what they determine to be the value of your car

- Different insurance companies may have varying formulas when calculating your car’s ACV

After your car is damaged in an accident, your insurance company may either reimburse you to help repair it or pay you the car’s value. But, it may not be as much as you think.

The amount your insurance company pays you depends on what they determine to be the value of your car. So, how do insurance companies value cars? For starters, they look at your car’s actual cash value (ACV).

To guarantee you receive the money you’re due, it’s important to understand the nuance around car values. This guide will walk you through the process and help you choose the right insurance coverage for you and your circumstance.

Actual Cash Value: What does that mean?

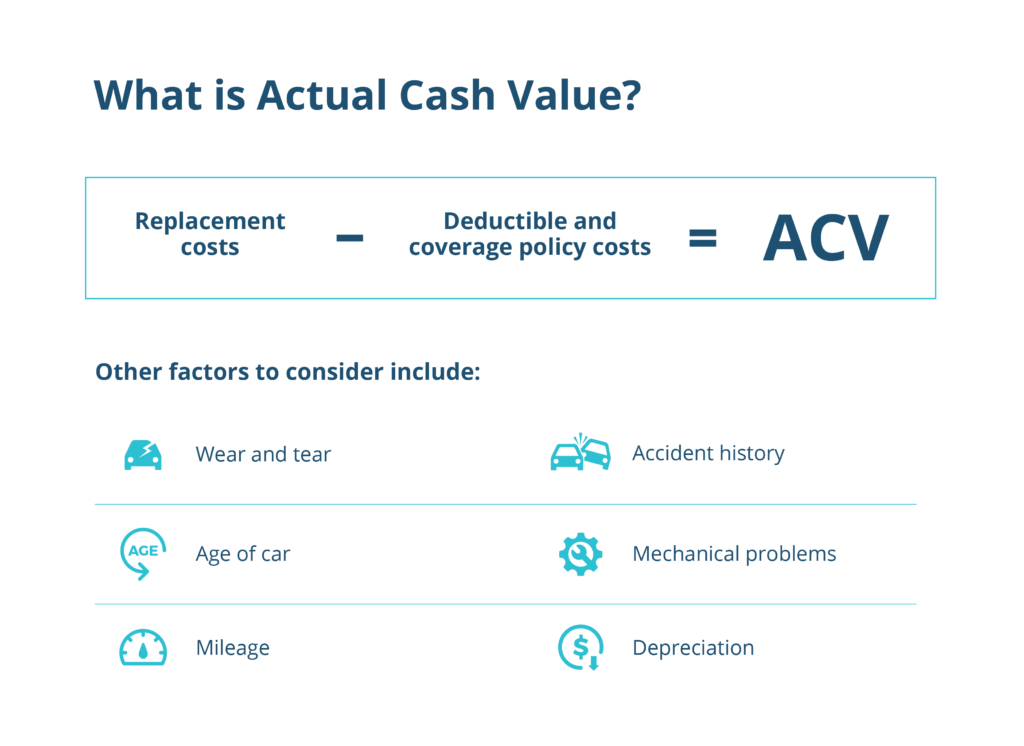

When your car is considered a total loss, your insurance company will pay you what they believe the value of your car was before the accident. So how do insurance companies determine your car’s actual cash value (ACV)?

When calculating the ACV, insurance companies subtract the deductible and coverage policy costs from the replacement costs. They may also consider factors such as:

- Wear and tear

- Age of car

- Mileage at the time of the accident

- Usage

- Cosmetic flaws

- Accident history

- Mechanical problems

- Depreciation

Different insurance companies may have varying formulas when calculating your car’s ACV. Generally, since cars depreciate as time goes on, you won’t receive the full amount you paid to buy the car. To that end, to maximize your car’s value, keep your car in great shape with regular maintenance.

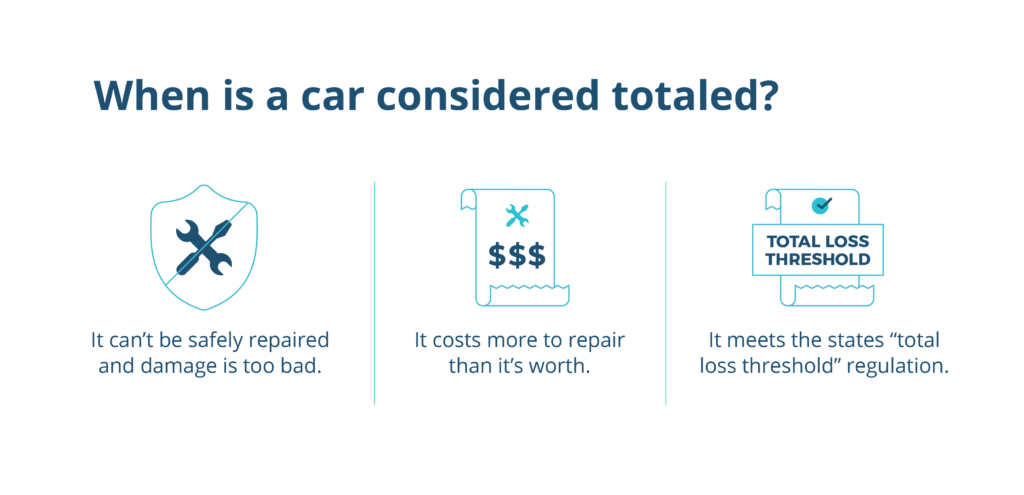

How do I know if my car is totaled?

When you have comprehensive and collision coverage, your insurance company will reimburse you to help repair your totaled vehicle. But, in certain situations, they may determine that your vehicle damage is a total loss and won’t pay to repair it.

Insurance companies declare that your car is totaled when:

- Your car can’t be safely repaired and the damage is too bad

- Your car cost more to repair than it’s worth

- Your car meets the state’s “total loss threshold” regulations

It’s important to note that you may not receive money back for a totaled car if you either leased it or have a loan. However, in the case of a loan, the insurance may help you to pay it off.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Actual Cash Value vs Replacement Cost

What insurance companies value your car to be is separate from what it costs to buy the same car. This is the difference between your car’s actual cash value and its replacement cost. Interested in knowing a bit more? Here’s more on their differences:

- Actual Cash Value – This is considered the default method that insurance companies use if your car is damaged, stolen, or totaled. It factors in the replacement cost minus your deductible and depreciation.

- Replacement Cost – This pays for a replacement vehicle of the same make and model. This method disregards depreciation entirely. It pays the full cost of the replacement minus your deductible.

The ACV is typically not enough for you to buy a new car that is valued the same, but the replacement cost covers you for a whole new car. Make sure to review your policies to verify what you have.

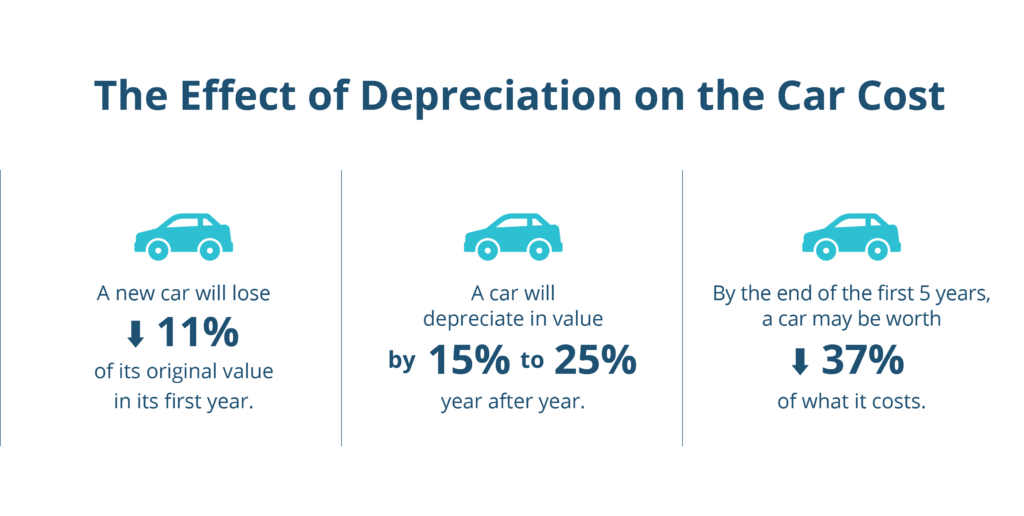

Depreciation Impacts Your Car’s Value

Maybe you’ve heard the saying that a car loses its value the moment it’s driven off the lot. While the sentiment is a bit extreme, there is some truth to it.

In that first year, your car does depreciate considerably. In an Edmunds study, they found that:

- Your new car will lose 11% of its value when you drive off the lot.

- Your car will depreciate in value by 15% to 25% each year in the first five years.

- By the end of the first five years, on average your car may be worth 37% of what it cost.

As the mileage in your car increases, it depreciates. Your insurance provider will take these factors into consideration as they determine your car’s ACV.

Additional Coverage Options

Are you leasing your car or using a loan to pay for it? If that’s the case, additional coverage may be necessary to guarantee that you’re fully covered and protected in the case of an accident.

Gap insurance or new car replacement coverage can help you fully replace your car with a new one. However, gap insurance is more affordable while the latter can be expensive and leave you in negative equity if you total your car right after you buy it:

- Gap Insurance – This insurance policy covers the difference between your car’s actual cash value and the amount you still owe on it. If you were to add this with your collision and comprehensive coverage, it would raise your premium to about $20 per year.

- New Car Replacement Coverage – Unlike gap insurance, this is a more expensive option. That’s because your insurance provider would be paying the full price to replace your car if it is totaled without including depreciation. Along with that, only a few insurers actually offer this option.

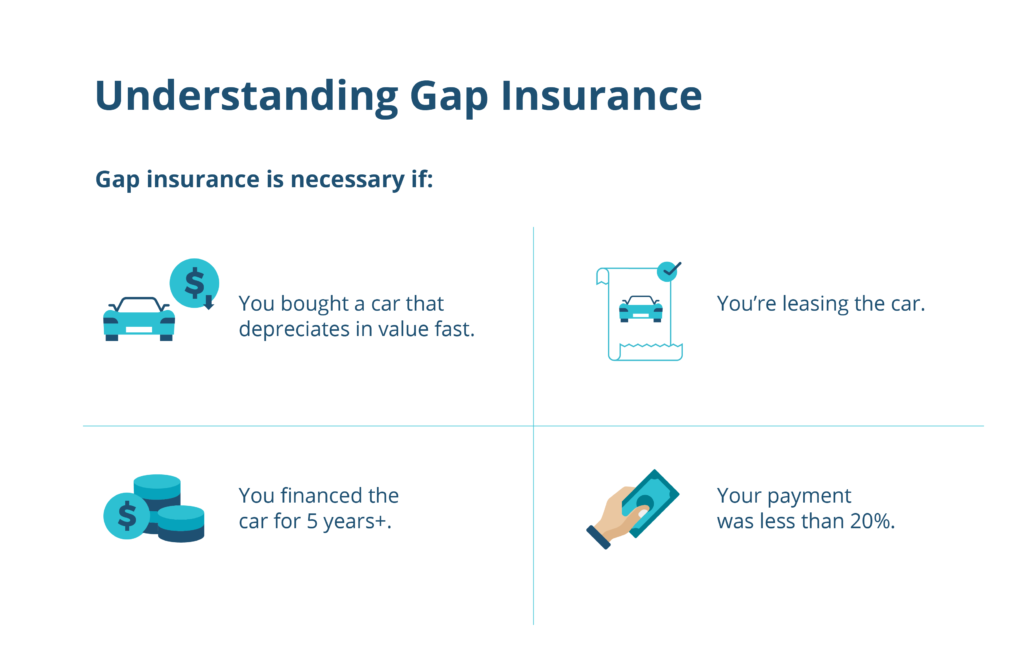

Gap Insurance Isn’t Always Necessary

How do you know if you need gap insurance? This accessible and affordable option may be necessary for you if:

- You bought a car that depreciates in value faster than the average car

- You’re leasing the car

- You financed the car for five years or longer

- Your down payment was less than 20%

How to Dispute the Valuation of Your Car

If you suspect your insurance company’s offer falls short, there are ways you can dispute it. The process for determining your car’s value can be tricky since insurance companies may be reluctant about paying the full price.

Sometimes, it may be necessary to negotiate on a price that you believe to be fair. So, how do you go about doing so? Well, let’s break it down:

- Determine Car Value – You need to first determine the value of your car. You can use online pricing guides, a trusted mechanic, or even third-party appraisers.

- Identify ACV Formula – It is also beneficial to find out the ACV formula that your insurance company uses to calculate your valuation.

- Start Negotiations – Present your price and a minimum price you deem acceptable to your insurance company. Luckily, this doesn’t require going into court.

- Provide Evidence – You’ll need to have proof that your insurance company’s valuation is lower than your car’s actual cash value.

Once you settle on a price, make sure to verify the agreement in writing. Also, keep in mind that the state the accident happened in can affect your car’s value.

Determining Your Car’s Value: Online Pricing Guides

To determine your car’s value, you need the right tools. Online pricing guides are there to help you estimate what your car may be worth. You can use these guides to research the value of your car:

- Kelley Blue Book

- National Auto Dealers Association

- Edmunds

When you do the research, you can get a better sense of a fair price. It is also good evidence to have when you’re attempting to dispute your insurance company’s valuation.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Agreed Value vs Stated Value for Classic Cars

When it comes to antique or classic cars, how insurers determine your car’s value changes a bit. The main reason for this is that classic cars don’t depreciate like your regular, everyday car. So, if your classic car is totaled, you have two options: agreed value and stated value.

What’s the difference?

- Agreed Value – You agree with your insurer on a set value that they’ll pay you minus your deductible if your car is ever totaled. This agreed value amount is set in stone. But whenever it is time to renew your insurance policy, if your car has appreciated (or increased in value), you can change the amount to reflect that.

- Stated Value – The stated value of your car is one you’ve determined with supporting evidence and documentation. However, your insurer can still choose to pay either the agreed value or the stated value depending on which is less.

The agreed value is a guaranteed amount while the stated value isn’t as secure. But, having the agreed value incorporated into your coverage policies can be pricier.

Why Insurance Companies May Refuse to Reimburse

Typically, your car insurance company will pay for any repairs or replacements. However, there are situations in which your company may refuse to do so. Because of that, you would be left having to pay for the damages out of your pocket.

To guarantee that you aren’t left with the bill, here are a few reasons why that may happen:

- You only pay for liability insurance

- The accident was your fault

- You violated the state law at the time of the accident

- Your claim extends beyond your coverage limits

Know Your Car’s Value

When your car is totaled or damaged because of an accident, you may be counting on your insurance company’s reimbursement to help cover the cost. Understanding the valuation process prepares you if you need to dispute their offer and negotiate a better one.

But, it also may be a sign you need a better insurance provider.

With our comparison tool, you can easily compare rates for free online and save money. Simply provide your zip code and information about your car. Then, find a provider that will offer you the best possible protection in the case of an accident.

Get started comparing auto insurance rates on our website today.

Sources:

Investopedia. Actual Cash Value. https://www.investopedia.com/terms/a/actual-cash-value.asp

Edmunds. Depreciation Infographic: How FAst Does My New Car Lose Value? https://www.edmunds.com/car-buying/how-fast-does-my-new-car-lose-value-infographic.html

Insurance Information Institute. What is gap insurance? https://www.iii.org/article/what-gap-insurance

Forbes. What You Need To Know About Car Valuation And Insurance. https://www.forbes.com/advisor/car-insurance/car-valuation/

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.